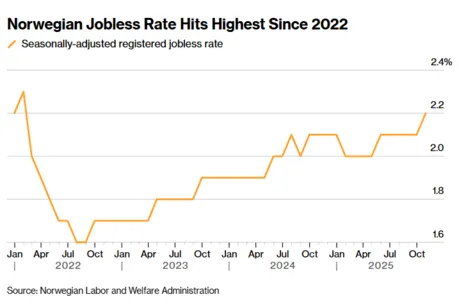

Norway’s labour market has begun to show signs of softening, with the latest data revealing that adjusted unemployment has reached its highest level since early 2022. The seasonally adjusted jobless rate rose to 2.2 percent, a small figure by global standards but a meaningful shift for a country that has operated with exceptionally low unemployment for several years.

For much of the past decade, Norway has benefited from a strong labour market supported by solid economic activity, high energy revenues, and steady private sector hiring. The latest increase, although moderate, suggests that the period of extremely tight hiring conditions may be coming to an end. More people are now actively seeking work, and companies appear less aggressive in expanding their workforce.

Several factors may explain the change. Some industries are experiencing slower activity as both domestic and international demand cools. A decline in job vacancies across multiple sectors has also made it harder for job seekers to secure positions quickly. In addition, there has been an inflow of younger and newly trained workers entering the labour force, which naturally pushes the unemployment rate slightly higher even if job creation stays positive.

Economists note that the labour market is not in distress and remains relatively strong. Employment levels are still high, and the overall participation rate has not dropped. However, an uptick in unemployment at this stage of the economic cycle can signal a broader shift. It may reflect caution among businesses amid concerns about slower growth, higher borrowing costs, and uncertainty in global markets.

For Norway’s central bank, the trend carries policy implications. If unemployment continues to rise and wage pressures ease, it could reduce inflation risk and influence future interest rate decisions. Lower wage growth would give the central bank more room to consider holding rates steady or even cutting them if economic momentum weakens. On the other hand, if the softening remains mild and inflation stays elevated, the bank may hesitate to move quickly.

For households, a gradual loosening of the labour market can affect confidence and spending behaviour, especially if people begin to worry about job security or slower wage increases. For businesses, it may offer some relief from labour shortages that were previously driving up costs, but it also signals that overall demand may no longer be as strong.

The key question now is whether the rise in unemployment will continue or level off. If the figures stabilize, it could simply mark a normalisation after years of unusually strong labour conditions. If they continue upward, it may point to a broader economic slowdown.

Norway still benefits from its strong energy sector, high productivity, and sizable financial buffers, all of which provide protection against a sharp downturn. Even so, policymakers, workers, and employers will be watching closely in the months ahead to determine whether this is a temporary shift or the beginning of a more prolonged cooling phase in the labour market

Leave a Reply