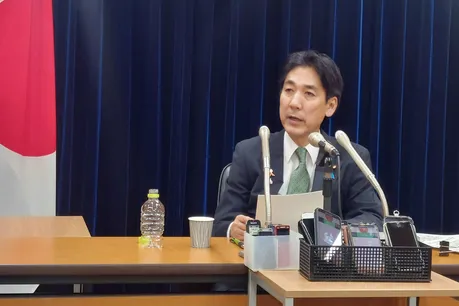

Japan’s newly appointed economic policy minister has indicated that the government is not excluding the possibility of issuing bonds to fund a large economic stimulus package. While tax revenues and budget reallocations remain preferred funding sources the government acknowledges that depending on the size and urgency of the package additional debt may be needed.

This development is significant because Japan already carries one of the highest public debt burdens among advanced economies. A decision to issue new government bonds will draw attention to how sustainably the country can manage its borrowing over the medium term. At the same time the government faces pressure to respond to rising costs of living weak wage growth and external economic challenges which warrant strong fiscal measures.

Key factors influencing the outcome include the estimated scale of the economic package voter and business expectations the condition of global and domestic demand and investor sentiment toward Japanese bond issuance. If bond issuance becomes large markets could interpret it as a signal of weakening fiscal discipline raising yields and borrowing costs. Conversely if the stimulus supports sustained growth and tax revenues improve the decision to borrow could be seen as wise and forward-looking.

The government must navigate a delicate balance between delivering immediate support and maintaining credibility with investors and credit rating agencies. A well-designed package funded primarily through existing resources supplemented by careful borrowing may help protect both short-term economic recovery and long-term fiscal health.

For now the message from Tokyo is clear: issuing bonds remains an option not a decision. The next steps will depend on the details of the stimulus plan how urgent the support is and how confident policymakers are about future revenue growth

Leave a Reply