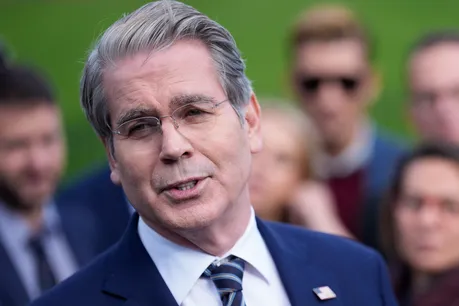

Prominent investor Scott Bessent has urged Japan’s government to give the Bank of Japan (BOJ) more independence and flexibility to combat inflation effectively. As Japan continues to face shifting economic conditions after years of ultra-loose monetary policy, Bessent’s comments highlight growing concerns that political pressure could interfere with the central bank’s efforts to maintain long-term price stability.

Japan has been experiencing inflation levels that are higher than its traditional norm, a change that has challenged policymakers who for decades struggled with deflation and weak demand. The BOJ, under Governor Kazuo Ueda, has been gradually signaling a willingness to adjust its yield curve control policy and reconsider its stance on negative interest rates. However, the transition has been cautious, reflecting fears that rapid tightening could slow the fragile economic recovery.

Bessent emphasized that Japan’s government should trust the central bank to handle inflation without interference. He argued that allowing the BOJ sufficient space to act independently is essential to prevent inflation from becoming entrenched. According to him, political influence or hesitation to change policy could delay necessary adjustments, potentially causing more harm to the economy in the long run.

In recent months, the yen has remained under pressure as interest rate differentials between Japan and other major economies, such as the United States, have widened. The weak yen has driven up import costs, contributing to rising prices for energy, food, and consumer goods. While some policymakers in Tokyo have expressed concern over the yen’s weakness, Bessent believes that market forces should play out naturally as the BOJ fine-tunes its monetary policy.

He also pointed out that the central bank’s credibility depends on its ability to make independent decisions. In his view, the BOJ must strike a careful balance between curbing inflation and supporting growth, but this process should not be politicized. Bessent noted that other major central banks, including the Federal Reserve and the European Central Bank, have been given the space to respond to inflation pressures, and Japan should do the same if it wants to restore investor confidence.

Japan’s inflation, which had long remained below the BOJ’s two percent target, has now persisted above that level for more than a year. Although much of the rise has been driven by higher import prices, recent wage increases and stronger domestic demand suggest that underlying inflationary pressures may be taking hold. This marks a significant shift from Japan’s decades-long battle with deflation, during which policymakers often prioritized stimulus over tightening.

Bessent’s remarks come as investors and analysts debate when the BOJ might finally begin unwinding its extraordinary monetary easing measures. Any move toward normalization is expected to have global implications, particularly for bond markets and currency exchange rates.

In conclusion, Bessent’s call for Japan to give the Bank of Japan room to act underscores a fundamental principle of central banking: independence is key to effective inflation management. As Japan stands at a critical crossroads, the ability of the BOJ to make decisions free from political constraints could determine whether the country successfully navigates this new era of inflation or risks slipping into prolonged instability once again

Leave a Reply