The surge in artificial intelligence spending that once seemed concentrated among a few major tech giants is now spreading across a broader range of companies, easing investor concerns that the AI boom could be a short-lived bubble. As earnings season progresses, a growing number of firms are reporting tangible financial benefits from AI adoption, signaling that the technology’s impact on corporate profitability is becoming both deeper and more diverse.

For much of the past two years, investor enthusiasm for AI was driven largely by a handful of leaders such as Nvidia, Microsoft, and Alphabet. Their strong earnings and skyrocketing stock prices fueled fears that the AI rally might be overhyped, resting on speculative expectations rather than real economic growth. However, recent earnings reports show that AI-related gains are no longer limited to chipmakers and cloud providers. Companies in sectors such as manufacturing, finance, healthcare, and retail are now seeing measurable returns from AI integration.

In the latest quarter, several firms credited AI-driven efficiency gains for improving their margins and cutting operational costs. Industrial companies have reported better supply chain management and predictive maintenance using machine learning tools. Financial institutions are deploying AI to enhance risk modeling, detect fraud, and personalize customer services, while healthcare firms are accelerating drug discovery and diagnostics through advanced data analytics. These developments suggest that AI’s benefits are moving beyond hype and into widespread practical application.

Analysts note that the widening of AI earnings strength across multiple industries represents a key turning point for the market. It demonstrates that AI is not just a narrow growth story centered around big tech but a transformative technology reshaping traditional business models. This broader adoption helps reduce fears of an investment bubble by showing that AI is delivering real value across the economy.

Equity strategists are also observing a healthier market dynamic. Earlier in the year, a small cluster of AI-linked mega-cap stocks accounted for most of the gains in major indexes such as the S&P 500 and Nasdaq. That narrow leadership had raised concerns about market concentration and vulnerability to a sharp correction. Now, with more companies reporting AI-driven revenue growth, market participation is widening, creating a more stable foundation for future gains.

One example of this shift can be seen in corporate spending patterns. Businesses are no longer merely experimenting with AI; they are embedding it into core operations. From logistics optimization to customer service automation, the technology is improving productivity and driving innovation. This wave of adoption has prompted analysts to revise earnings estimates upward for a range of industries previously viewed as less tech-dependent.

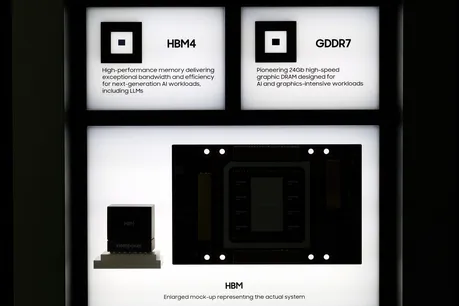

Still, challenges remain. The costs of AI infrastructure, including energy-intensive data centers and specialized hardware, remain high. There are also growing concerns about regulation, data privacy, and the potential for over-investment in unproven applications. Yet, even with these risks, the tone from executives and investors has shifted toward confidence that AI is delivering lasting structural benefits.

In conclusion, the broadening strength of AI-related earnings across industries is helping to ease fears that the current market enthusiasm is unsustainable. As companies continue to harness AI for real productivity gains and profit growth, the technology’s promise appears increasingly grounded in fundamentals rather than speculation. This new phase of adoption may mark the point where artificial intelligence transitions from a market-driven trend to a genuine engine of long-term economic transformation.

Leave a Reply