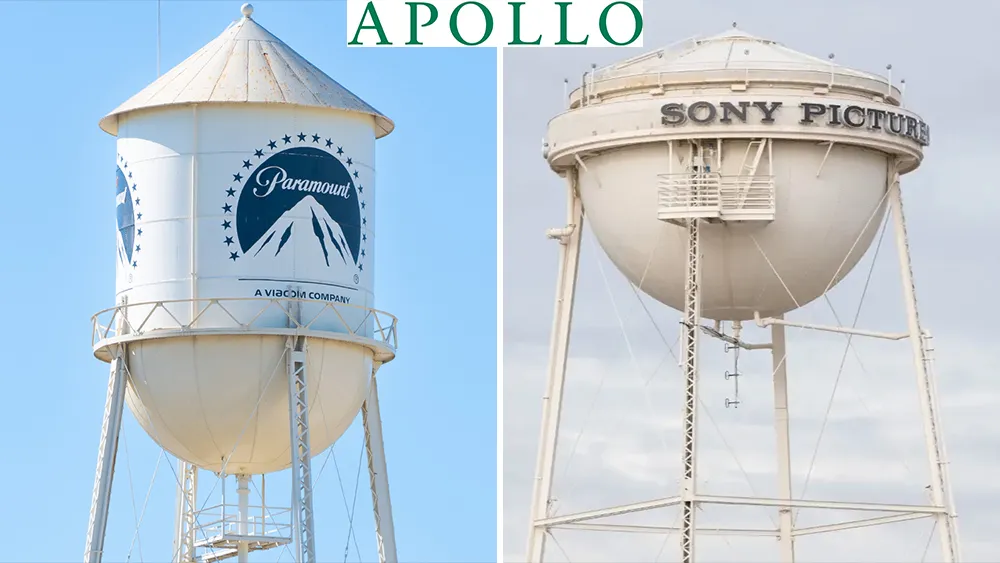

In a dramatic turn for Hollywood’s media landscape, Paramount Global is reportedly in preliminary talks with Apollo Global Management and Legendary Entertainment regarding a potential joint bid for Warner Bros. Discovery. If these discussions advance, it could reshape the global entertainment industry merging two legacy studios and altering the balance of power among media giants.

A New Chapter in Hollywood’s Consolidation Game

Over the past decade, the entertainment industry has witnessed a wave of mega-mergers from Disney’s acquisition of 21st Century Fox to Amazon’s takeover of MGM. Now, Paramount’s possible collaboration with Apollo and Legendary signals the next major shake-up in the streaming and studio wars.

According to insiders, Apollo a global private equity firm with vast media investments and Legendary Entertainment, best known for hits like Dune and Godzilla vs. Kong, are exploring strategic ways to team up with Paramount. The talks reportedly center around evaluating Warner Bros. Discovery’s market value, existing debt load, and potential synergies that could benefit all parties.

Why the Deal Matters

The potential acquisition comes at a critical time for the entertainment industry. Both Paramount Global and Warner Bros. Discovery have faced challenges adapting to the fast-evolving streaming era. Paramount+, the company’s flagship streaming platform, continues to grow but remains behind Netflix and Disney+. Meanwhile, Warner Bros. Discovery is battling debt after its 2022 merger and struggling to balance profitability with content expansion.

A successful deal could consolidate valuable assets including Warner Bros. Pictures, HBO, CNN, and Discovery Channel under one umbrella, creating a media powerhouse capable of competing with streaming giants. Analysts suggest that Apollo’s financial backing could provide the necessary capital to stabilize operations and drive international growth.

Strategic Interests of Apollo and Legendary

Apollo Global Management has shown growing interest in media and content investments. Partnering with Paramount would not only give it a foothold in the entertainment ecosystem but also allow it to influence the direction of one of Hollywood’s most storied studios.

Legendary Entertainment, on the other hand, brings creative muscle and global box office appeal. The company has a long-standing relationship with Warner Bros., making it a natural fit for discussions surrounding a potential acquisition.

Challenges and Market Reaction

Despite the buzz, significant hurdles remain. Regulatory approval for such a large merger would be complex, especially in the current U.S. political climate where antitrust scrutiny is rising. Moreover, both Paramount and Warner Bros. Discovery are carrying heavy debts raising questions about financial feasibility and investor confidence.

Market reactions have been cautiously optimistic. Paramount’s shares rose modestly following the news, reflecting investor interest in potential consolidation. However, analysts warn that without clear financial structures, the talks could stall like many other speculative mergers in Hollywood’s history.

The Bigger Picture

If the deal materializes, it could mark one of the largest entertainment mergers of the decade, reshaping Hollywood’s competitive dynamics. For audiences, it might mean more unified content offerings and potentially better cross-platform experiences. For the industry, it signals a continuing trend: survival through consolidation.

Conclusion

Paramount’s reported discussions with Apollo and Legendary show that Hollywood’s merger mania is far from over. As streaming platforms dominate consumer attention and traditional media struggles to adapt, strategic alliances like this could determine which players thrive and which fade into history.

Leave a Reply