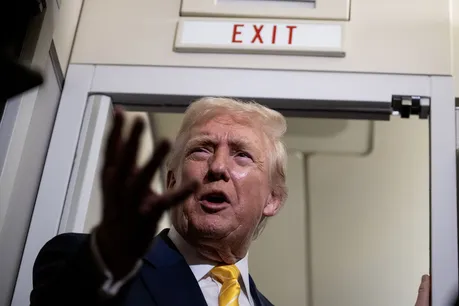

The idea of easing financial pressure on Americans has become a major theme in recent political debates. As the cost of living rises and household budgets tighten, leaders are exploring ways to make daily life more affordable. Among these proposals is a plan put forward by former President Donald Trump that suggests offering a two thousand dollar tariff rebate to consumers. While the idea is presented as a way to provide relief, it has not been warmly received by many of his traditional allies. The hesitation around this plan reveals deeper political and economic tensions that shape how policy ideas are judged today.

At its core, the rebate plan is meant to help Americans cope with higher prices by returning some of the money collected from tariffs. Tariffs are taxes placed on imported goods, and they often lead to higher prices for consumers. By offering a rebate, the plan aims to offset those extra costs. In theory, this could make goods more affordable and give households a small but meaningful financial boost. However, turning this idea into reality is far more complicated than it appears on the surface.

One major challenge is the position of conservative lawmakers and business groups who traditionally support lower taxes and fewer government interventions. To them, a rebate program looks like a new spending initiative that requires additional administrative work and significant funds. Many of these allies prefer policies that reduce taxes directly rather than create government systems to redistribute money. Because of this, they view the rebate plan as a move that does not fit comfortably with their long standing priorities.

Another barrier is the concern that rebates might undermine the purpose of tariffs. Tariffs are meant to protect domestic industries by making imported goods more expensive. Supporters of this strategy argue that higher import costs encourage companies to manufacture products within the country. If consumers receive rebates that offset the extra cost, the impact of the tariff could weaken. This contradiction makes some allies question whether the plan truly strengthens American businesses or simply creates short term political appeal.

There is also the problem of fairness and distribution. Deciding who receives the rebate, how much they receive, and how the program is managed raises many questions. Some people worry that the system might become confusing or inefficient. Others argue that the benefits may not reach those who need them most. The complexity of administering a nationwide rebate program adds to the skepticism among policymakers who prefer simpler economic tools.

Beyond the technical issues, political dynamics also play a significant role. Allies who generally support Trump may hesitate to endorse a proposal that could be difficult to defend publicly. With many voters already concerned about government spending and inflation, backing a plan that appears costly or complicated could create political risks. Supporters want strategies that are easy to explain and feel immediately effective. The rebate proposal struggles to meet those expectations.

In the end, the plan highlights the difficulty of addressing affordability in a way that satisfies both economic principles and political realities. While the goal of helping Americans is widely supported, the path forward is not straightforward. The debate around the rebate shows how challenging it is to craft a policy that aligns with ideological beliefs, works efficiently, and responds to real financial pressure. For now, the proposal remains a hard sell among allies who prefer clearer, more traditional approaches to economic relief.

Leave a Reply