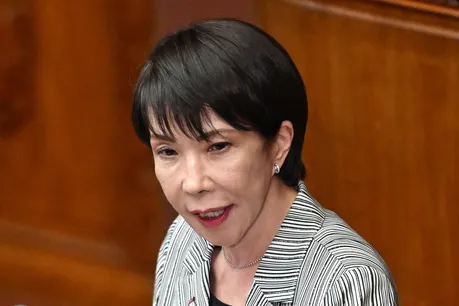

Japan’s Economic Security Minister Sanae Takaichi has recently signaled a major shift in economic policy by supporting a looser budget goal, marking a notable change from the country’s long-standing commitment to fiscal discipline. This move reflects a growing focus on stimulating growth and addressing structural challenges in the Japanese economy rather than strictly controlling government debt. The decision has sparked debate among policymakers and economists, as it could influence Japan’s fiscal and economic strategy for years to come.

For decades, Japan has struggled with a delicate balance between promoting growth and maintaining fiscal responsibility. As one of the most indebted advanced economies in the world, Japan has traditionally aimed to reduce its budget deficit and achieve a primary balance surplus. However, weak growth, low inflation, and demographic pressures have made these goals increasingly difficult to meet. Takaichi’s call for a more flexible approach indicates a recognition that strict budgetary limits may be hindering the government’s ability to respond effectively to economic challenges.

The new stance comes at a time when Japan is facing both internal and external pressures. Domestically, an aging population and shrinking workforce are placing significant strain on public finances and social programs. Externally, global economic uncertainty, rising energy prices, and shifts in trade dynamics are testing Japan’s economic resilience. In this environment, Takaichi’s approach suggests that stimulating domestic demand and supporting innovation are more urgent priorities than immediate fiscal tightening.

Under the proposed shift, the government may allow greater spending on areas such as defense, energy security, and technological development. These investments are seen as essential for Japan’s long-term competitiveness and national security. Takaichi has emphasized the importance of ensuring that fiscal policy supports economic stability and strategic objectives rather than focusing solely on debt reduction targets. This represents a continuation of Prime Minister Fumio Kishida’s “new capitalism” agenda, which seeks to balance growth with inclusivity and sustainability.

Critics, however, warn that loosening fiscal discipline could increase risks to Japan’s already high public debt levels. With the government debt exceeding twice the size of the economy, some economists argue that continued borrowing could limit future policy flexibility. They stress the importance of maintaining a credible plan for fiscal sustainability to avoid putting pressure on bond markets or future generations. Still, supporters of Takaichi’s approach argue that Japan’s low interest rate environment and strong domestic investor base make additional borrowing manageable, especially if it leads to productive growth.

In conclusion, Sanae Takaichi’s decision to support a looser budget goal signals a significant change in Japan’s economic direction. It highlights a shift from austerity toward strategic investment and growth-oriented policies. While the move carries potential risks, it also opens the door for Japan to address long-term structural issues and enhance its global competitiveness. The coming months will show how this policy shift unfolds in practice, but for now, it marks a bold step toward a more flexible and forward-looking economic strategy for the country

Leave a Reply